The CTV market is growing 15-20%/year while linear TV shrunk 8% last year, and CTV is expected to reach $33B in 2025. Despite this growth, the market is quite fragmented, with Hulu, YouTube, and Roku as the only platforms making more than $2B annually.

The streaming platforms are angling for their piece of the pie, with Netflix, Disney, and Amazon all rolling out ad-supported tiers of their services in the past 12 months, and massive players Disney, Warner Bros. Discovery, and Fox are combining to bring the last vestige of appointment-based watching: SPORTS! to a new app in the Fall.

Meanwhile, Google is chillin in the corner raking in revenue from the cord-cutters and avid football fans with YouTubeTV and billions of hours of streaming content with YouTube.

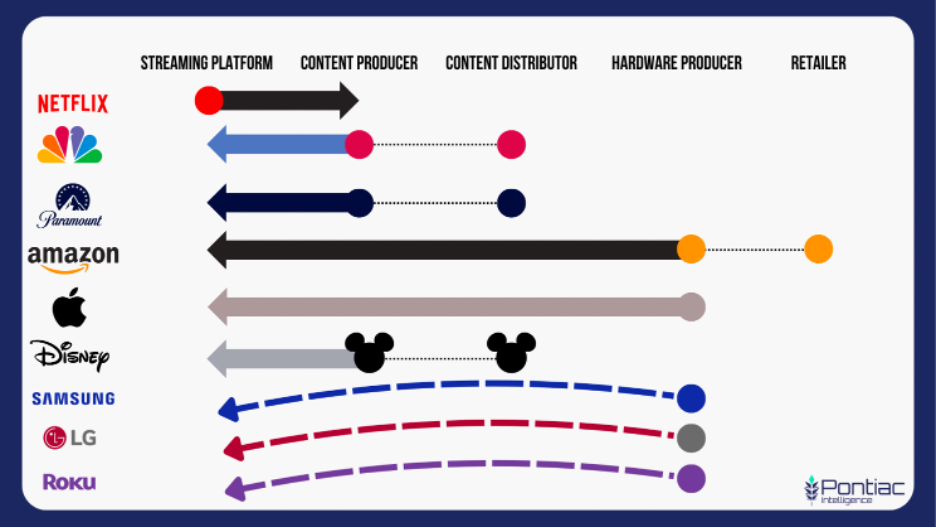

In the past 5 years, we’ve seen streaming giants become content creators (Netflix), content creators become content distributors (HBO/Max), content creators become streaming upstarts (Disney+, NBC/Peacock, CBS/Paramount+), hardware producers become streaming upstarts (Samsung/LG/Apple/Roku) and content creators (Apple+), and retail giants become streaming giants/content creators (Amazon Prime).

The common denominator? Monetizing as many eyeballs for as long as possible as much as they all possibly can. This is why all of these content producers and distributors, hardware producers, and retailers have all shifted left on this chart. If you don’t have direct access to eyeballs, you can’t scale your profit margins.

And that’s why….

Wait, what was that? I heard someone come into the room.

Hello?

Oh hey, Walmart! What’s up? How ya been?

What’s that? You made $160B in your last earnings report, but ended up with 74% less net revenue than Netflix who only made 5% of your top line revenue over the same period ($8.5B)?

You’re right, that is a bummer… Can I get back to my newsletter post now? Thanks.

Where was I? Oh right!

And that’s why the biggest retailer IN THE WORLD just went in big on access to eyeballs, and to capitalize on a fragmented, growing industry. With the proliferation of CTV, TV manufacturers inevitably went from fancy hardware companies to the owners of the central, communal computer screen of 74% of homes in the US. This is why Samsung, Roku, and LG are now as focused on ads as they are on hardware. With the acquisition of Vizio, Walmart gains a foothold into the living rooms of 18MM Vizio Smartcast users and secures a spot on the express train to Marginville.

They still have a very long way to go: Vizio’s 18MM Smartcast users pale in comparison to Netflix’s 80+MM subscribers in the US and Canada and is an intimate gathering compared with the 2024 projected 172MM Amazon Prime members, but the market for free ad supported TV (FAST) continues to grow and each dollar earned through CTV is worth $0.20 in profit vs. $0.002 in profit in grocery/retail, so an 18MM user head start ain’t a bad place to kick things off. There is no definitive winner yet, and Walmart knows that you can’t win if you don’t play the game.

As the CTV market continues to scale upwards, and consumers start to tighten their wallets and cut down on subscriptions, any company positioned to sell ad space on FAST inventory will benefit, and Walmart is now in a place to eat market share and diversify their revenue growth away from hard goods using their new living room Trojan horse.

Who knows, before you know it, you’ll be eating snacks purchased from Walmart on your Walmart Vizio TV, watching Walmart produced content supported by Walmart procured advertising for companies selling their products at Walmart. Kind of sounds like Amazon…